December 2017 Gold Market Charts

The December issue of BullionStar’s ‘Gold Market Charts’ looks at developments in the world’s major physical gold markets during November, the latest month for which the relevant data is available. Each month, this series of article uses gold charts from the GOLD CHARTS R US market charting website.

SGE Gold Withdrawals

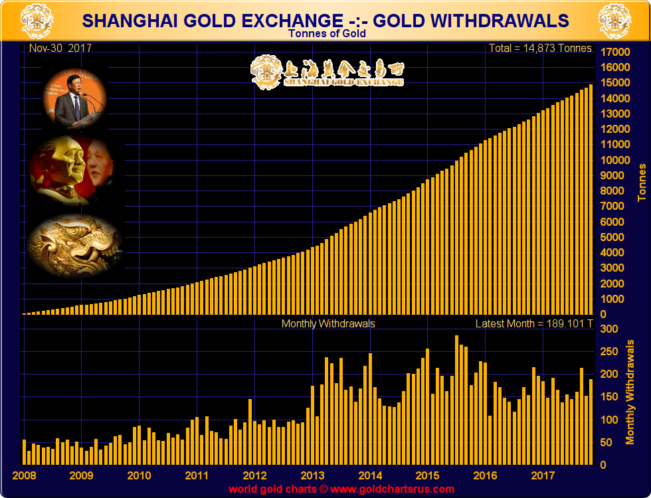

Physical gold withdrawals from the vaults of the Shanghai Gold Exchange (SGE) totalled 189.1 tonnes during November 2017. These gold withdrawals are a suitable proxy for Chinese wholesale gold demand due to the fact that nearly all gold supply in the Chinese domestic gold market is traded through Shanghai’s gold bourse, and all gold for the SGE contracts has to be stored in the Exchange’s vaults.

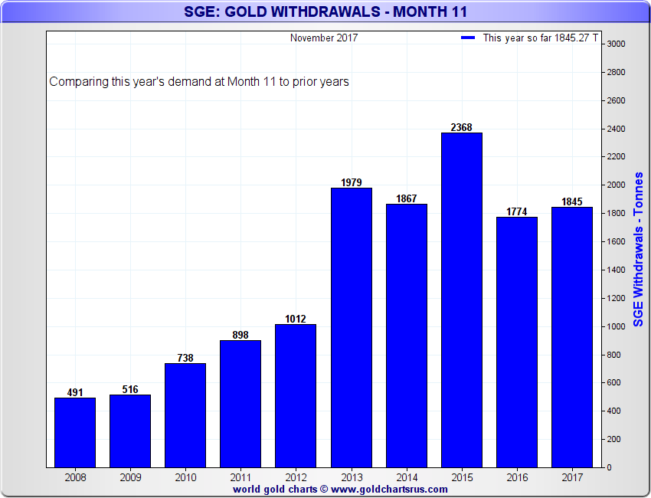

On a year-to-date basis for the 11 months from January to November, a total of 1845 tonnes of gold has been withdrawn from the SGE vaults, putting 2017 gold demand in China on a par with the year 2014, and ahead of 2016.

December’s gold withdrawal data from the SGE, released in January, will confirm whether 2017 was the 3rd highest ever or 4th highest ever year for Chinese wholesale gold demand.

Chinese and Indian Gold Demand (CHINDIA)

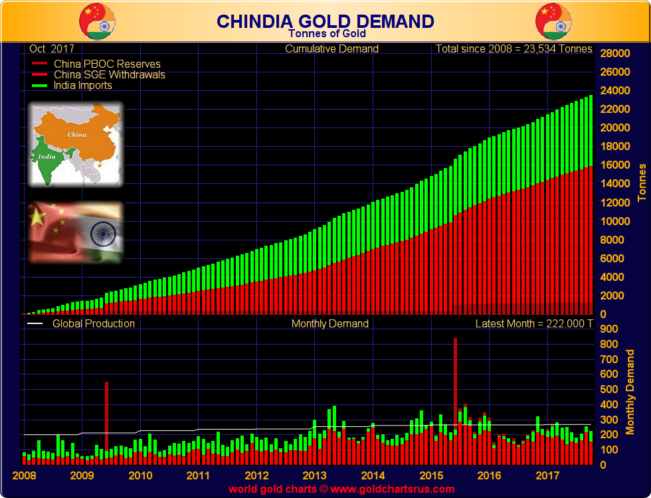

The unique CHINDIA gold chart captures the strength of gold demand across the world’s two largest gold markets, India and China. The logic of the chart is that it combines net Indian gold imports (a proxy for Indian gold demand) and SGE gold withdrawals (a proxy for Chinese wholesale gold demand). A third demand source in the form of Chinese central bank gold reserves is also added, due to the fact that the Chinese central bank does not purchase gold on the SGE, meaning that Chinese central bank demand is distinct from Chinese wholesale gold demand.

The latest CHINDIA chart is for October 2017 due to the fact that official Indian gold import data is released with a 2 month lag. During October 2017, CHINDIA physical gold demand totalled 222 tonnes, which comprised 151.5 tonnes for SGE Gold Withdrawals, and net gold imports into India of approximately 70 tonnes. The gold demand component from the Chinese central bank was zero in October, because, as per every month for over a year now, the People’s Bank of China has not announced any additions to its official gold reserves.

Russian Gold Reserves

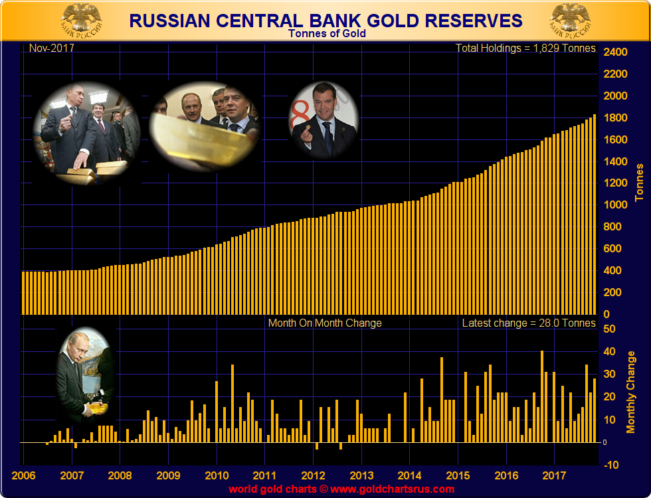

In December, the Bank of Russia (central bank for the Russian Federation), announced that it had added another 28 tonnes to its official gold reserves in November, taking its purchases of gold during 2017 to 214 tonnes. As per 2016, the Bank of Russia will probably not have added any gold during December, so the 214 tonne addition up to the end of November probably represents the full extent of Russian central bank gold buying for the year.

The Russian State, through the Bank of Russia, now holds 1829 tonnes of gold, which is only 13 tonnes less that the 1842 tonnes of gold which the Chinese central bank claims to hold. It remains to be seen whether the Chinese central bank will allow the Russian central bank to bypass it in the world official gold holdings table, where the two nations are now neck and neck in 5th and 6th places, behind France, Italy, Germany and the US.

The Chinese central bank most likely has a lot more gold than it publicly states it holds, so it would probably be quite simple for the People’s Bank of China to announce a jump in its gold holdings at a time of its choosing. Will this timing be during January or February 2018? We will have to wait and see.

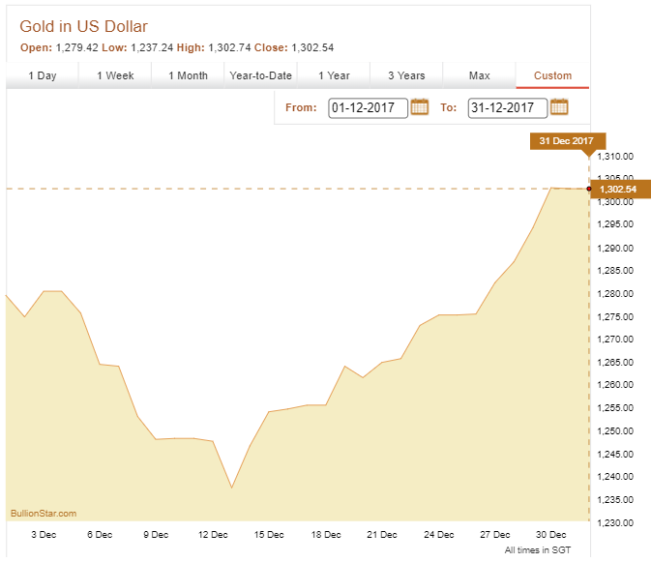

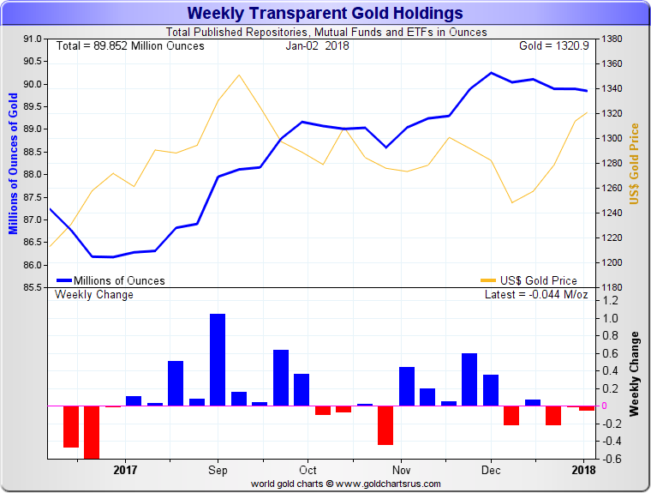

Transparent Gold Holdings and Gold Price

After months of trading in a tight range between US $1250 and US $1300, the gold price as measured in US dollars began an upward climb during mid-December which continued through to the end of the year. From an intra-month low of US $1237 on 13 December, the US dollar price advanced by more than 5% to just over US $ 1302 on 31 December.

For the full year 2017, the US dollar gold price started 2017 at approximately US $1150 per troy ounce, and made a series of approaches towards the US $1300 level in the first and second quarters, while remaining in a tight trading range above US $1200. However, the price only rose up above the US$ 1300 level for a few weeks during September, before reverting back into its limited trading range above US $1250, and ending the year at the US$1300 mark. Overall, the US dollar price of gold rose by approximately 13% during 2017.

The series of gold-backed ETFs, gold-backed investment platforms, and other transparent gold holdings (such as futures exchanges inventories) maintained combined gold holdings of about 90 million ounces (2800 tonnes) during December.

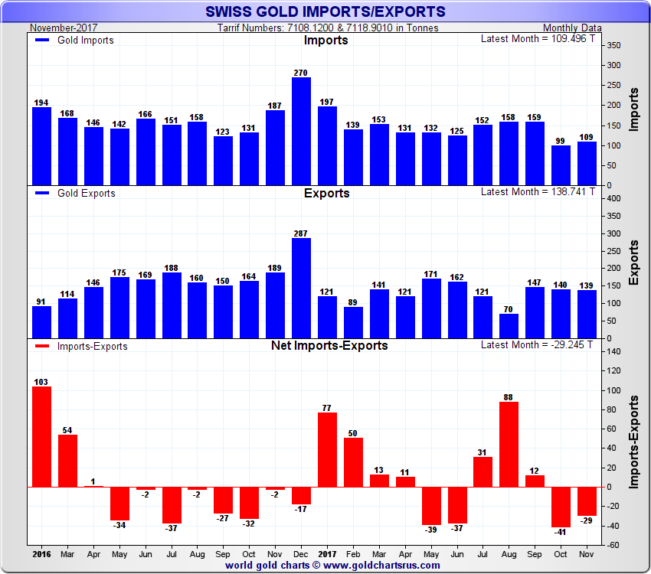

Swiss Gold Imports and Exports

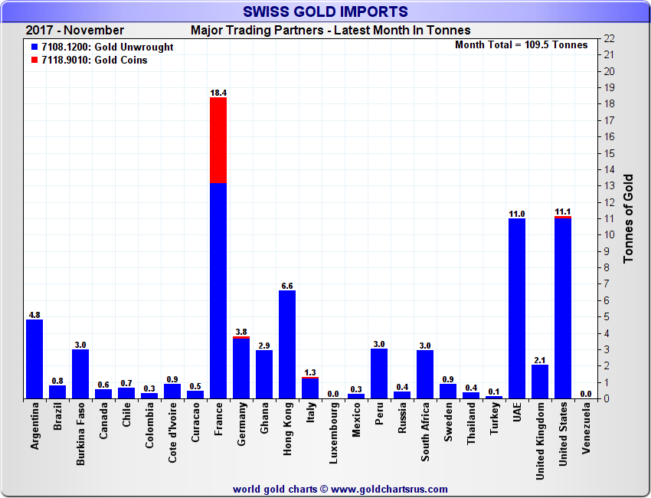

According to Swiss Federal Customs, during November, Switzerland imported 109 tonnes of non-monetary gold, while exporting 139 tonnes of non-monetary gold. This level of gold imports was the second lowest of the year, with only the month of October recording a lower monthly outflow.

Unusually, France was the biggest source for gold imports into Switzerland during the month, sending a total of 18.4 tonnes of gold to the Swiss, of which approximately 5 tonnes was in the form of gold coins. This is not the first month this year that France has sent significant quantities of gold coins to Switzerland (presumably for melting down), but its unusual that gold coins in such quantities are moving out of France with regularity.

Other large sources of gold imports into Switzerland during November were the UAE (Dubai), the US and Hong Kong.

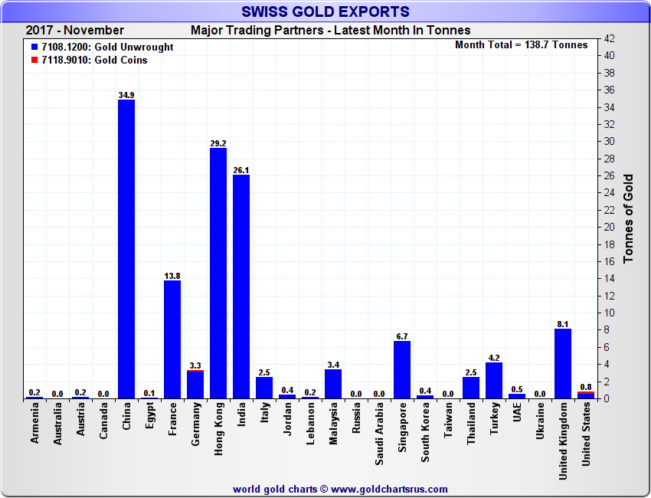

As per normal, China, Hong Kong and India were the 3 biggest destinations for Swiss non-monetary gold exports during November, and together these 3 locations accounted for 65% of all gold exports from Switzerland during the month. China took in 34.9 tonnes of gold, Hong Kong 29.2 tonnes, and India 26.1 tonnes. Notably, Switzerland also exported 13.8 tonnes of gold to France during November. Some of this was most likely in the form of gold bars being sent back to France that were fabricated from gold coins sent from France to Switzerland during previous months.

Popular Blog Posts by Gold Market Charts

November 2018 Gold Market Charts

November 2018 Gold Market Charts

May 2018 Gold Market Charts

May 2018 Gold Market Charts

December 2017 Gold Market Charts

December 2017 Gold Market Charts

November 2017 Gold Market Charts

November 2017 Gold Market Charts

October 2017 Gold Market Charts

October 2017 Gold Market Charts

September 2017 Gold Market Charts

September 2017 Gold Market Charts

August 2017 Gold Market Charts

August 2017 Gold Market Charts

July 2017 Gold Market Charts

July 2017 Gold Market Charts

June 2017 Gold Market Charts

June 2017 Gold Market Charts

May 2017 Gold Market Charts

May 2017 Gold Market Charts

Gold Market Charts

Gold Market Charts 0 Comments

0 Comments