Where Did All the Silver Coins Go?

In times past, small denomination coins were made of silver. The U.S. quarter dollar, for instance, once contained 90% silver, which meant that each quarter had 5.6 grams of precious metals. But in 1965 the U.S. Mint stopped issuing coins with silver in them. These days, a quarter is mostly copper with some nickel.

In the UK, coins contained 92.5% silver up until 1920, and after that were 50% silver. But nowadays, there isn’t a trace of precious metals to be found in any of the circulation coins minted by the Royal Mint.

Why did coins go from being composed mostly of silver to having no silver at all? The answer is simple: technological progress. People discovered that the monetary system worked more efficiently once the denominations formerly represented by silver coins were replaced by coins that contained base metals like nickel and copper. In this post I’ll walk through how “silverless" coins improved the monetary system. But first we have to head back 200 years to the early 1800s.

The Great 1816 Recoinage

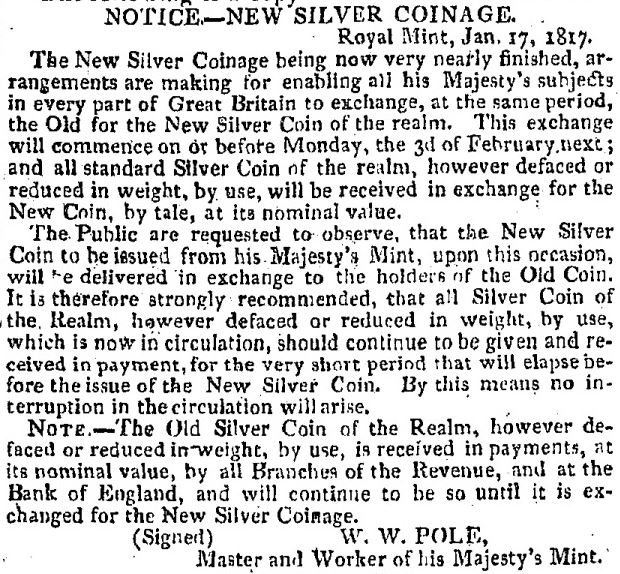

At the outset of this post I mentioned several famous 20th century reductions in the silver content of coins. But these were preceded by a series of prior reductions. One of the very first curtailments in silver’s role in coins occurred in Britain in the early 1800s. In 1816, with the passage of the Coinage Act, Parliament declared that the Royal Mint would henceforth reduce the weight – and thus the silver content – of Britain’s silver coinage. Shillings, crowns, and half-crowns would all be affected.

This was a big deal! For centuries, the Royal Mint had guaranteed that any new shilling that it minted would contain ~5.6 grams of silver. From 1817 on, this long tradition would come to an end. The silver content of a freshly-minted shilling would be reduced by 6% to ~5.2 grams.

Even though British coins now contained 0.33 grams less silver, Parliament declared that they were to have the same value as before. So a new shilling – though lighter than the old one – would still be worth 1/20th of a gold pound, just as it had been in decades past. For the average British coin user, the passage of the Coinage Act didn’t change anything. Their lighter shillings could buy just as much food, beer, and clothing as before.

Tokens vs full-bodied coins

Parliament’s proclamation didn’t just reduce the silver content of Britain’s coinage. It changed the very nature of Britain’s coins. Silver coins issued by the Mint had always been full-bodied. This meant that at the time it was issued, a shilling contained about a shilling’s worth of silver in it. Put differently, the market value of a new shilling was equal to the market value of the metals of which it was composed. But after 1816, England’s silver coins would no longer be full-bodied. They would function as tokens.

A token coin is worth more than the market value of the metal of which it is made of. For example, with one post-1816 shilling – which contained 5.2 grams of silver – Brits could purchase around 5.5 grams of silver. (This is at the 1817 market price of just over 5 shillings/ounce of standard silver, or 0.16 shillings per gram). In other words, a shilling’s worth of silver was worth more than the silver in the shilling.

How could a shilling be worth more than its silver content? The issuer – the Royal Mint – promised to limit the supply. If necessary, the government would repurchase or redeem tokens at their face value with gold coins or banknotes. Lastly, legal tender laws forced debtors to accept these coins at their face value, not their metal value. This set of guarantees ensured that tokens passed at a premium to their bullion value.

Bimetallism and coin shortages

The reduction in the silver content of the coinage and the adoption of token format was a brilliant way to fix a very particular problem that was then plaguing Britain: shortages of small change. Coin shortages were a fairly typical under a bimetallic standard. This was the monetary system that Britain had officially been on for several centuries.

Under bimetallism the pound unit of account – the £ – was jointly defined by the monetary authorities as either a fixed amount of gold or silver coins. This had the effect of establishing an exchange rate between gold and silver. But the system broke down whenever the authority’s chosen exchange rate for the two metals diverged from the market’s exchange rate. When this happened, one of the two metals would be undervalued relative to the other. In Britain’s case, it had been undervaluing silver since the beginning of the 1700s.

Thanks to the undervaluation of silver, silver coins like shillings were more valuable if they were melted down, exported, and sold at their true value as bullion. There had thus been almost no silver coins in circulation in Britain through most of the 1700s and early 1800s. But Brits were in desperate need of small value coins like pennies and shillings to purchase goods and pay salaries. Shortages of change meant that trade became difficult to carry out.

Here is how one letter writer in 1771 described the problem:

“The scarcity of Change has been severely felt by People in Trade for upwards of these Ten years past, and this Scarcity increases daily; and base designing People avail themselves of it, by getting Credit for trifling Sums, which they never intend to pay."

Stop the melting

The 1816 recoinage removed the incentive to melt down coins for their bullion value. By instituting a 6% decrease in the silver content of the shilling, half crown, and crown, Parliament ensured that the market value of silver in each of these coins was significantly below the coin’s market value. Henceforth, it would make little sense for a Brit to melt down a shilling in order to use it as bullion – said shilling would always be worth far more in coin format. This brought an immediate end to coin shortages and the resulting chills these shortages imposed on trade.

The only way that Britain would re-encounter coin shortages is if the market price of silver, which was then at 5 shillings per ounce (or 0.16 shillings per gram), spiked to around 6 shillings per ounce and stayed there. At that point the shilling would cease to be a token. The value of the 5.2 grams of silver in a post-1816 shilling would be worth more than the shilling itself, and it would once again be melted down. But this did not become a problem: silver prices would stay low for many decades.

An earlier private response

Parliament’s 1816 introduction of a token coinage was one of the first attempts to solve the coin shortages caused by high silver prices. But it wasn’t the first. In his book Good Money, George Selgin chronicles the private sector’s earlier attempts to tackle shortages of small change by issuing private coinage. By the late 1700s, industrialists like Matthew Boulton and Thomas Williams were minting large quantities of copper coins to pay their own workers, or for sale to clients who needed small change. These were smaller coins like pennies and halfpennies, nothing as large as the shilling (one shilling = 12 pennies). Below is an example.

Penny token, 1811

Due to government mismanagement of the coinage, private issuers like Samuel Fereday were relied on to meet British demand for change. Private copper coinage was banned in 1818, but Fereday’s tokens were “still common" in 1866, according to @GeorgeSelgin. pic.twitter.com/YhC8hvkgj9

— JP Koning (@jp_koning) April 4, 2019

Initially Britain’s private coiners focused on producing low-denomination copper, but by 1811 they had moved into manufacturing larger denomination silver coins as well. These commercial coins were tokens, not full bodied coins. Wary of the threat of their coinage being melted down for its silver value, manufacturers were careful to ensure that the silver content of their coins was less than the coin’s face value. The public willingly accepted these “light" tokens at their face value, not their metal value, because the issuer promised to redeem them on demand at their face value at their offices, often with banknotes.

These private issuers thus pioneered the solution to Britain’s general shortage of small change. Parliament’s belated introduction of token coins in 1816 was by no means a trailblazing maneuver – the government was simply replicating a technology that private sector “guinea pigs" had trialed years earlier.

Meanwhile in the U.S.

Like Britain, the U.S. was also crippled by small change shortages. Thanks to a rising price of silver in the 1840s, the bullion value of U.S. silver coinage exceeded its face value. Low-value silver denominations like dimes and quarters began to disappear as they were melted down.

The U.S. Mint issued full-bodied coins. But the Coinage Act of 1853 changed this by converting silver coins into tokens. The Act lowered the weight of the silver half dime, dime, quarter dollar, and half dollar by 7%. So whereas a pre-1853 quarter dollar was minted with 6.01 grams of silver, the post-1853 quarter contained just 5.6 grams. This removal of silver effectively reversed any incentive Americans had to melt coins down for their silver. Just as England’s removal of silver had cured its shortages decades before, the U.S.’s silver reduction ended its own shortage.

Subsequent reductions in silver

Through the 1800s, both the U.K. and U.S. relied on silver tokens to meet their citizens’ demands for small change. But from time to time these token systems would be tested as the market price of silver rose and pushed the value of the bullion in a coin above that coin’s face value. At that point they would once again be melted down and exported, a coin shortage resulting.

This is exactly what happened when the world price of silver spiked in 1919 and early 1920. In the U.K., the 5.2 grams of silver in a shilling was suddenly worth more than the shilling itself. Parliament reacted to the increase in silver’s price by reducing the fineness of the silver coinage from 92.5% sterling to 50%. Thus the weight of each shilling stayed the same while its silver content was cut back to 2.6 grams. Large-scale melting down of British coins was therefore avoided.

Canada, my home country, reacted to the same rise in the price of silver by reducing the fineness of all of our silver coinage from 92.5% to 80% in 1920. In 1922, we removed all the silver from the five-cent piece and issued a “99.9% nickel" nickel.

Thanks to bureaucratic inertia, the U.S. never responded to the 1919-1920 silver price spike with its own reduction in the silver content of its coinage. The market price of silver soon fell and the threat of melting receded. But in the late 1950s and early 60s, a bull market in silver returned, and once again U.S. silver coins began to disappear. In 1965, President Lyndon B. Johnson solved the problem once and for all by removing all silver from the coinage.

Canada would follow this up in 1968 by replacing all of the silver in our dimes and quarters with nickel. Both Canada and the U.S. were simply following the U.K., which had gone silverless in 1946.

In Conclusion

The steady removal of silver from coinage since the early 1800s was a response to crippling coin shortages. As the metal value of the nation’s coinage exceeded its face value, coins were withdrawn from circulation and melted down. By replacing silver with less valuable metals like copper, the problem was solved.

The small change problem is by no means a solved one. In the mid-2000s, the price of commodities exploded higher. This caused the value of the base metals in the U.S. one- and five-cent pieces to exceed their face value. In an effort to stop Americans from melting these coins down, the U.S. Mint declared coin melting to be illegal.

For now this prohibition (and the drop in commodity prices) seems to have reduced the threat of melting. But come the next doubling or tripling in commodity prices, it’s hard to imagine that people will pay much heed to the U.S. Mint’s prohibition against melting. In which case the government may have look back to 1853 or 1965 for inspiration – and replace copper and nickel with cheaper materials.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 10 Comments

10 Comments