Central Bank Gold at the Bank of England

In a recent article, “How many Good Delivery gold bars are in all the London Vaults?….including the Bank of England vaults“, I considered how much gold is actually in the London Gold Market, and highlighted how the amount of gold stored in the London wholesale market has fallen noticeably in recent years.

That article highlighted that the amount of gold stored in custody at the Bank of England (BoE) fell by 350 tonnes during the year to 28 February 2015, after also falling by 755 tonnes during the year to end of February 2014. Therefore, by 28 February 2015, there was, according to the BoE’s own statement, £140 billion or 5134.37 tonnes of gold in custody of the BoE, or in other words ~ 410,720 Good Delivery gold bars.

The article also reviewed snapshots of the total amount of gold stored in the London vaults at various recent points in time.

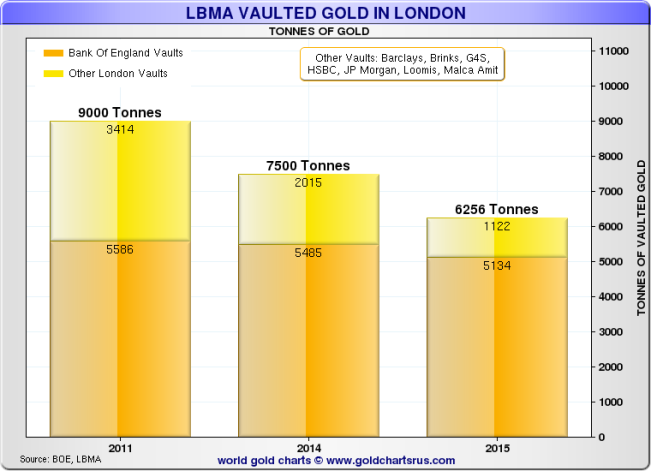

Firstly, a reference on the London Bullion Market Association (LBMA) web site for a date sometime before 2013 stated that there had been 9,000 tonnes of gold (i.e. 720,000 Good Delivery bars) stored in London with two-thirds of this amount, or 6,000 tonnes, stored in the Bank of England (about 482,000 bars), and 3,000 tonnes stored in London ex Bank of England vaults (238,000 bars). (Nick Laird of Sharelynx subsequently pointed out to me that the earliest reference to this 9,000 tonne figure was from a LBMA presentation from November 2011.)

Secondly, by early 2014, the LBMA web site stated that there were only 7,500 tonnes of gold in all London vaults, i.e. ~600,000 bars, and of this total, three-quarters or 5,625 tonnes were at in Bank of England, ~ 450,000 bars, and only one-quarter or 1,875 tonnes was stored at LBMA London gold vaults excluding the Bank of England’s gold vaults.

So, the entire London market including the Bank of England had lost 1,500 tonnes (120,000 bars) between 2011 and early 2014, with 375 tonnes less in the BoE and 1,125 tonnes less in the London market outside the BoE.

Finally, on 15 June 2015, the LBMA stated that “There are ~500,000 bars in the London vaults, worth a total of ~US$237 billion”. This ~ 500,000 bars equates to 6,256 tonnes. (On 15th June 2015, the morning LBMA Gold Price was set at $1178.25, which would make $237 billion worth of gold equal to 201.145 million ounces, which is 6,256 tonnes).

Therefore, another ~1,250 tonnes of gold (approximately 100,000 Good Delivery bars) departed from the London gold vaults compared to the early 2014 quotation of 7,500 tonnes of gold in the London vaults.

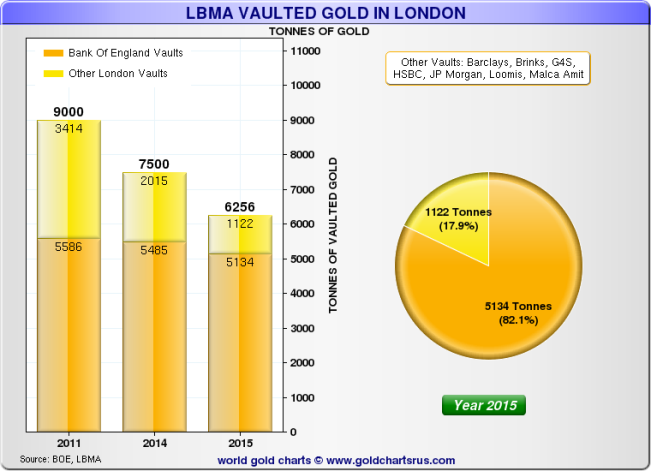

So overall, between the 9,000 tonnes quotation in 2011, and the 6,256 tonnes 2015 quotation, some 2,750 tonnes (~ 220,000 Good Delivery bars) disappeared from the London gold vaults. With 6,256 tonnes of gold stored in the entire London vault network in 2015, and with 5,134 tonnes of this at the Bank of England, that would leave 1,122 tonnes of gold in London outside the Bank of England vaults.

To reiterate, “the London gold vaults“, in addition to the Bank of England gold vaults, refer to the storage vaults of JP Morgan and HSBC Bank in the City of London, the vaults of Brinks, Malca Amit and Via Mat (Loomis) located near London Heathrow Airport, the vault of G4S in Park Royal, and the Barclays vault managed by Brinks.

Because the Bank of England reveals in its annual report each year the value of gold it has stored in custody for its customers (central banks, international official sector institutions, and LBMA member banks), then it is possible to compare 3 years of gold tonnage figures, namely the years 2011, 2014 and 2015, and then show within each year how much of this gold is stored at the Bank of England, and how much is stored in London but outside the Bank of England vaults.

Nick Laird of www.sharelynx.com / www.goldchartsrus.com has done exactly this in the following sets of fantastic charts which he has created to graphically capture the above London gold trends, and a lot more besides. These charts are just a subset of a suite of inter-related gold charts that Nick has created to address this critical subject in the London Gold Market.

Although the Bank of England is not a LBMA member, the Bank of England gold vaults are a critical part of the LBMA gold vaulting and gold clearing system, and LBMA bullion banks maintain gold accounts with the Bank of England which facilitate, among other things, gold lending and gold swaps transactions with central banks. Hence the above and below charts are titled “LBMA Vaulted Gold in London".

My “How many Good Delivery gold bars are in all the London Vaults" article had also quantified that nearly all of this ~1,122 tonnes consists of gold from physical gold-backed ETFs which store their gold in the London vaults. (previously rounded up to 1,125 tonnes for ease of calculation).

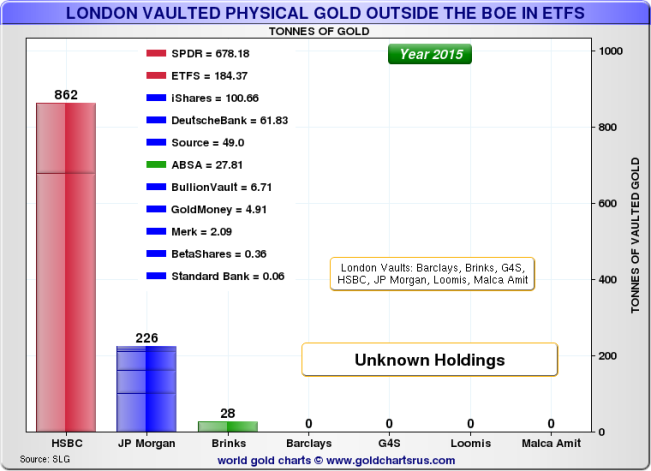

I had included 5 gold ETFs in my previous analysis namely, SPDR Gold Trust (GLD), Shares Gold Trust (IAU), ETF Securities – ETFS Physical Gold ETF (PHAU & PHGP), ETF Securities – Gold Bullion Securities (GBS & GBSS), and Source Physical Gold ETC (P-ETC), and also some smaller holdings at BullionVault and GoldMoney. In total these ETFs and other holdings accounted for just over 1,000 tonnes of gold in the London market.

However, I had missed a few other gold ETFs which also store their gold in the London vaults. Nick Laird, whose Sharelynx website maintains up-to-date gold ETF data and gold holdings, took the initiative to fill in the missing ETF blanks and Nick re-calculated the more comprehensive ETF holdings figures for London, which worked out at an exact 1,116 tonnes of gold, astonishingly close to the implied figure represented by the 1,122 tonnes outside the Bank of England vaults.

The additional gold backed ETFs also included in Nick Laird’s wider catchment were Deutsche Bank db Physical Gold ETC and associated Deutsche ETFs, ABSA gold ETF (of South Africa), Merk Gold ETF, and some smaller holdings from Betashares and Standard Bank. The following chart from Sharelynx shows the full data for physically backed gold ETFs storing their gold in London:

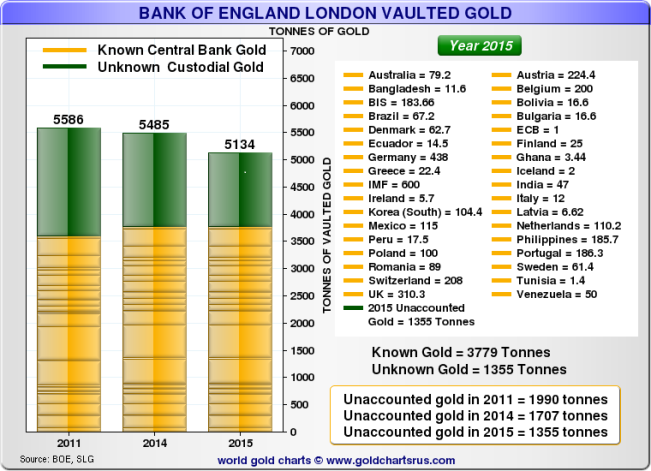

We then discussed an approach, in conjunction with Koos Jansen and Bron Suchecki, to identify known central bank gold stored in the Bank of England vaults by tallying up this storage data on a country level basis. So, for example, assuming 5,134 tonnes of gold stored at the Bank of England in early 2015, the aim would be to try to account for as much of this gold as possible using central bank sources.

As mentioned in the ‘How many gold bars‘ article, the Bank of England stated in 2014 that 72 central banks (including a few official sector financial organisations) held gold accounts with the Bank. It is not known if any of these gold accounts are inactive or whether any of these accounts have zero gold holdings. The LBMA stated in 2011 that “The Bank of England acts as gold custodian for about 100 customers, including central banks and international financial institutions, LBMA members and the UK government". Therefore there could also be more than 25 LBMA member commercial banks with gold accounts at the Bank of England.

Some of the Bank of England 5,134 tonne total would therefore be gold held in LBMA member bank gold accounts at the Bank of England, for which data is not public. Likewise, a lot of central banks do not reveal where their gold is stored, let alone how much is stored in specific vaults such as at the Bank of England and Federal Reserve Bank of New York.

However, many central banks have more recently begun to provide some information on where they say their official reserve gold is stored. Other central banks have always been to some extent transparent. Overall, a variety of sources, where possible, can be used to source locational data regarding central bank gold storage locations. There will continue to be gaps however, since some central banks remain non-cooperative, even when asked directly about where they stored their gold.

Tallying this type of central bank gold storage data will probably be a work in progress. However, there has to be a cut-off point for doing a first pass through the data, and this is a first pass. As a group, the European central banks have been especially forthcoming with gold storage data, compared to even 3-4 years ago (except for Spain). For other central banks, I looked in various places such as their financial accounts, and I contacted some of them by email with varying degrees of success. About half of the 72 central banks on the Bank of England’s list were identified, again, with varying degrees of accuracy.

The following fantastic chart by Nick Laird captures an overview of this Bank of England gold storage data. Essentially the chart shows that the banks listed hold, or have stated that they hold, the respective quantity listed, and in total the named banks could account for x tonnes gold stored at the bank of England. This is labelled ‘Known Gold‘. Given ‘Known Gold’, this leaves the residual as ‘Unknown Gold‘.

The remainder of this article explains the logic and the sources behind each country, and why that country appears on the list. When a central bank claims to have stored gold at the Bank of England, or the evidence suggests that, it does not necessarily mean that the gold in question is held in custody in a gold set aside account or that it is allocated in identifiable bars, or even that it is actually there. Many central banks engage in gold lending, or have done so in the last 15-20 years, and have at times, or permanently, transferred control of that gold to LBMA bullion banks.

Until all central banks come clean about what form their gold holdings are in, which will never happen, then the amount of central bank gold that’s encumbered by bullion banks or under claims, liens, loan agreements etc will not be apparent.

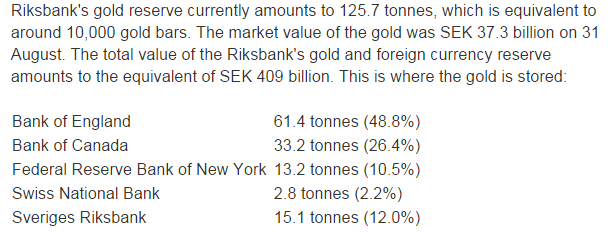

SWEDEN

Sweden holds 125.7 tonnes of gold, and 48.8%, or 61.4 tonnes are stored at the Bank of England.

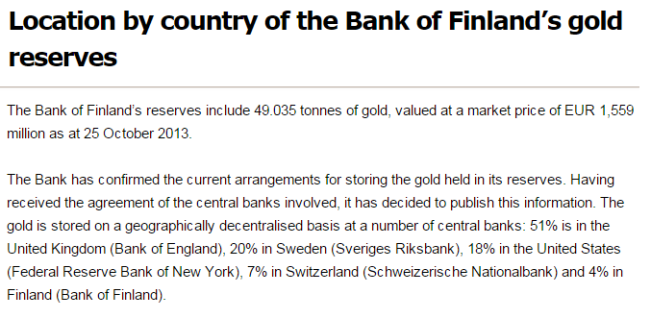

FINLAND

Finland holds 49.035 tonnes of gold, and 51%, or 25 tonnes are stored at the Bank of England.

GERMANY

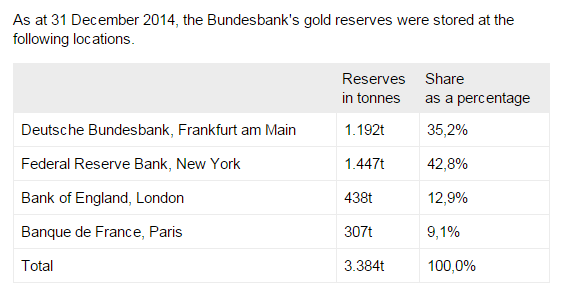

Germany holds 3,384 tonnes of gold, and 12.9%, or 438 tonnes are stored at the Bank of England. The Bundesbank’s ongoing repatriation of gold from New York and Paris does not alter the amount of Bundesbank gold held at the Bank of England.

Austria

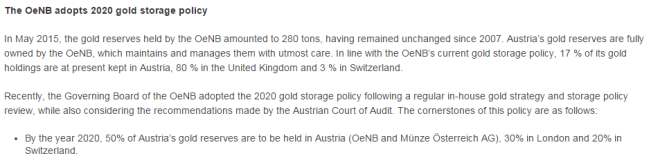

Austria hold 280 tonnes of gold, and 80%, or 224 tonnes are stored at the Bank of England.

Switzerland

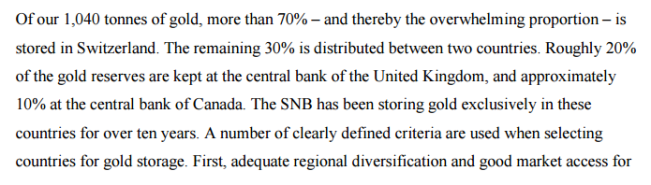

Switzerland holds 1,040 tonnes of gold, and approximately 20%, or 208 tonnes are stored at the Bank of England.

Portugal

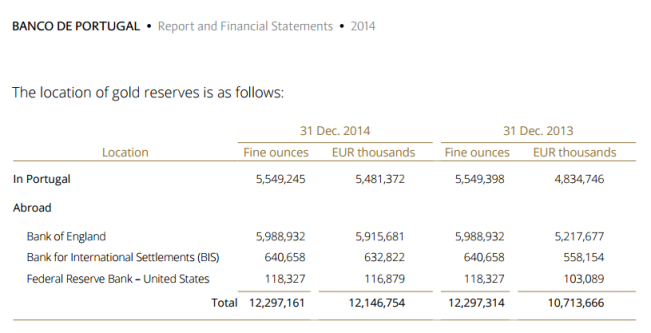

Portugal holds 382.5 tonnes of gold (annual report 2014), and 48.7%, or 186.3 tonnes are stored at the Bank of England.

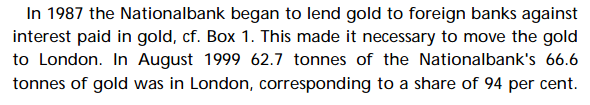

Denmark

The following commentary about Denmark’s gold contains some key points on understanding how to identify which countries store gold at the Bank of England.

As of August 2015, Danmarks Nationalbank (the Danish central bank) holds 65.5 tonnes of gold.

In August 2015, the Nationalbank said that:

“Most of Danmarks Nationalbank’s gold is stored at the Bank of England, where it has been since it was moved for safety reasons during the Cold War. In March 2014, Danmarks Nationalbank inspected its stock of gold in the Bank of England."

However, an earlier Nationalbank publication in 1999 said that 94%, or 62.7 tonnes was stored at the Bank of England.

Therefore, the assumption here is that 62.7 tonnes of Danish gold is stored at the Bank of England.

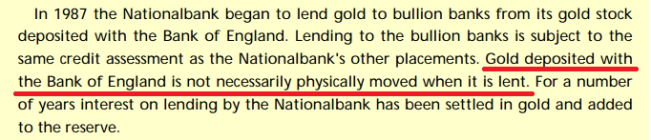

Note the Danmarks Nationalbank’s assertion that in order for gold to be lent it has to be moved to the London, since London is the centre of the gold lending market.

In 1999 “Almost 99 per cent, or 93 per cent of the Nationalbank’s total gold stock, had been lent." The same 1999 Danish central bank article also said that:

I have underlined the above sentence since it’s of critical importance to understanding that in gold lending, central bank gold lent to LBMA bullion banks at the Bank of England does not necessarily move out of the Bank of England vaults. Lent gold may or may not move out the door, depending on what the borrower plans to do with the borrowed gold.

It also means that the total gold in custody figure that the Bank of England reveals each year (for example £140 billion in February 2015), consists of:

a) central bank gold stored at the Bank of England

b) bullion bank gold stored at the Bank of England

c) central bank gold that has been lent or swapped with bullion banks (gold deposits and gold swaps) and that has not been moved out of the Bank of England vaults. This category of gold is still in custody at the Bank of England. The central bank claims to still own it, the bullion bank has control over it, and the Bank of England still counts it as being in its custody.

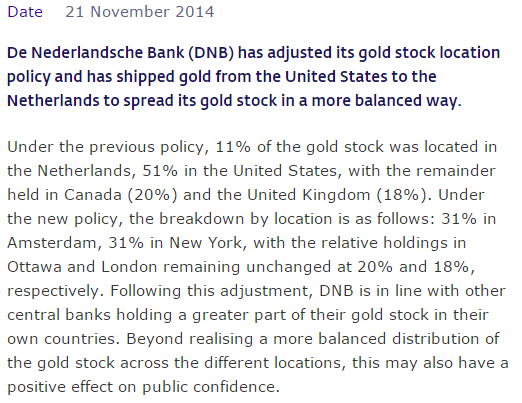

Netherlands

The Netherlands holds 612.5 tonnes of gold, and 18%, or 110 tonnes are stored at the Bank of England.

United Kingdom

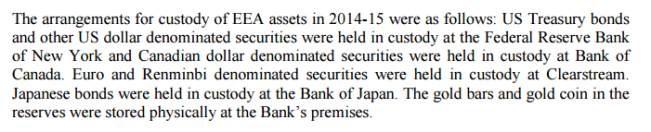

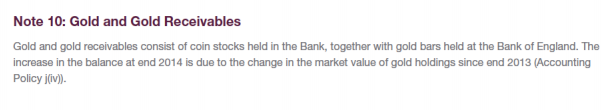

The UK gold reserves are held by HM Treasury within the Exchange Equalisation Account (EEA). EEA gold reserves totals 310.3 tonnes, and all 310.3 tonnes are stored at the Bank of England.

Notice that the UK gold reserves includes holdings of gold coin, as well as gold bars.

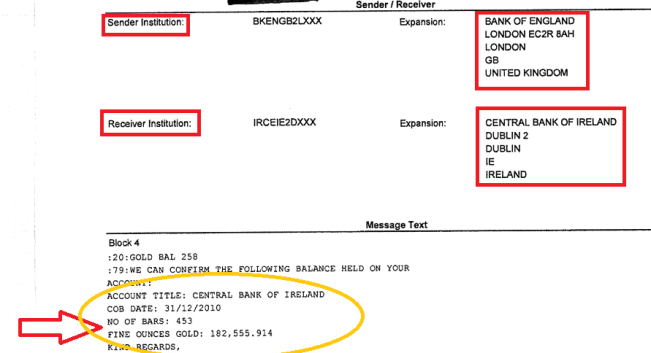

Ireland

Ireland hold 6 tonnes of gold in its official reserves, a small amount of which is in the form of gold coins, but nearly all of which is in the form of gold bars stored at the Bank of England.

Recently, I submitted a Freedom of information (FOI) request to the Central Bank of Ireland requesting information such as a weight list of Ireland’s gold stored at the Bank of England. After the FOI request was refused and the Central Bank of Ireland claimed there was no weight list, I appealed the refusal and was provided with a SWIFT ‘account statement’ from 2010 that the Bank of England had provided to the Central Bank of Ireland. See below:

This statement shows that as of 31 December 2010, the Central Bank of Ireland held 453 gold bars at the Bank of England with a total fine ounce content of 182,555.914 ounces, which equates to an average gold content of 402.993 fine ounces per bar. It also equates to 5.678 tonnes, which rounded up is 5.7 tonnes of gold stored at the Bank of England.

The fact that no weight list could be tracked down is highly suspicious, as is the fact that Ireland had in earlier years engaged in gold lending, so did not, at various times in the 2000s have all of its gold allocated in the Bank of England. How a central bank can claim to hold gold bars but at the same time cannot request a weight list of those same bars is illogical and suggests there is a lot more that the Central Bank of Ireland will not reveal.

Belgium

Belgium holds 227 tonnes of gold, most of which is stored at the Bank of England with smaller amounts held with the Bank of Canada and with the Bank for International Settlements. Banque Nationale de Belgique (aka Nationale Bank van België (NBB)) does not publish an exact breakdown of the percentage stored at each location, however, in March 2013 in the Belgian Parliament, the deputy Prime Minister and Minister for Finance gave the following response in answer to a question about the Belgian gold reserves:

“Most of the gold reserves of the National Bank of Belgium (NBB) is indeed held with the Bank of England. A much smaller amount held with the Bank of Canada and the Bank for International Settlements. A very limited amount stored in the National Bank of Belgium."

Furthermore, there were a series of reports in late 2014 and early 2015 that would suggest that Belgium stores 200 tonnes of its gold at the Bank of England. Firstly, in December 2014, VTM-nieuws in Belgium reported that the NBB governor Luc Coene had said that the NBB was investigating repatriating all of its gold. See Koos Jansen article here.

On 4 February 2015, Belgian newspaper Het Nieuwsblad said that Belgium would repatriate 200 tonnes of gold from the Bank of England, but the next day on 5 February 2015, another Belgian newspaper De Tijd reported that NBB Luc Coene denied the repatriation report, and quoted him as saying:

“There are other and more effective ways to verify if the gold in London is really ours. We have an audit committee that inspects the Belgian gold in the UK regularly".

See another Koos Jansen article on the Belgian gold here. However, Luc Coene did not deny the figure of 200 tonnes of Belgian gold stored in London.

Therefore, the assumption here, backed up by evidence, is that Belgium stores 200 tonnes of gold at the Bank of England.

Australia

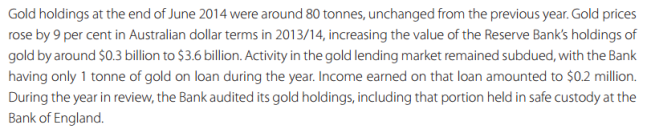

Australia holds approximately 80 tonnes of gold in its official reserves, with 1 tonne on loan, and 99.9% of gold holdings stored at the Bank of England. See 2014 annual report, page 33. According to a weight list of its gold held at the Bank of England, released via an FOIA request in 2014, Australia stores approximately 78.8 tonnes of gold at the Bank of England.

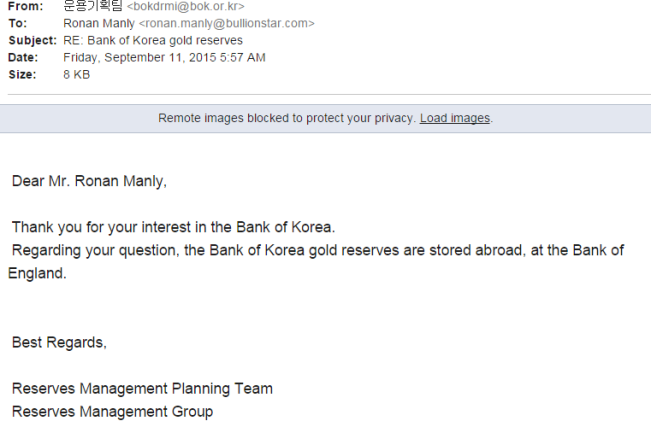

South Korea

South Korea (Bank of Korea) holds 104.4 tonnes of gold, 100% of which, or 104.4 tonnes is stored at the Bank of England. The Bank confirmed this to me in an email on 11 September 2015. See email here ->

International Monetary Fund

The IMF currently claims to hold 2,814 tonnes of gold after apparently selling 403.3 tonnes over 2009 and 2010 (222 tonnes in ‘off-market transactions and 181.3 tonnes in ‘on-market transactions’). Prior to 2009, IMF gold holdings had been 3,217 tonnes, and had been essentially static at this figure since 1980 [In 1999 IMF undertook some accounting related gold sale transactions which where merely sale and buyback bookkeeping transactions].

Although the IMF no longer provide a breakdown of how much of its gold is stored in each location where it stores gold, the amount of gold held by the IMF at the Bank of England can be calculated by retracing IMF transactions from a time when the IMF did provide such details. In January 1976, the IMF held 898 tonnes of gold at the Bank of England in London, 3,341 tonnes at the Federal Reserve Bank of New York, 389 tonnes at the Banque de France in Paris, and 144 tonnes at the Reserve Bank of India in Nagpur, India. Therefore, of the IMF’s total 4,772 tonnes holdings at that time, 70% was stored in New York, 19% in London, 8% in Paris and 3% in India. See here and here.

In the late 1970s, the IMF sold 50 million ounces of gold via two methods, namely, 25 million ounces by ‘public’ auctions, and 25 million ounces by distributions to member countries.

In the four-year period between mid-1976 and mid-1980, the IMF sold 25 million ounces of gold to the commercial sector via 45 auctions. Thirty five of these auctions delivered gold at the FRBNY, 7 of these auctions delivered gold at the Bank of England, and 3 of the auctions delivered gold at the Banque de France.

Of the 7 auctions that delivered the IMF’s gold at the Bank of England, these auctions in total delivered 3.74 million ounces [Dec-76: 780,000 ozs, Aug-77: 525,000 ozs, Nov-77: 525,000 ozs, May-78: 525,000 ozs, Oct-78: 470,000 ozs, Mar-79: 470,000, and Dec 79:444,000 ozs], which is 116 tonnes. See IMF annual report 1980.

The IMF also sold 25 million ozs of gold to its member countries within four tranches over the 3 year period from January 1977 to early 1980. These sales, which were also called gold ‘distributions’ or ‘restitutions’ and covered between 112 and 127 member countries across the tranches, were initially quite complicated in the way they were structured since they involved IMF rules around quotas which necessitated the gold being transferred to creditor countries of the IMF and then transferred to the purchasing countries. In the later sales in 1979 and 1980 countries could purchase directly from the IMF.

Countries could choose where to receive their purchased gold, i.e. London, New York, Paris or Nagpur, however, the US, UK, France and India, which had the largest IMF quotas and hence the largest gold distributions, all had to receive their gold at the respective IMF depository in their own country. I don’t have the distribution figures to hand at the moment for the 25 million ozs sold to countries, but about 18 countries took delivery from the Banque de France in Paris, with the rest choosing delivery from New York and London.

Therefore an assumption is needed on the amount of gold the IMF ‘distributed’ to member countries from its Bank of England holdings between 1977 and 1980. Of the 25 million ounces distributed, the US received 5.734 million ozs, the UK received 2.396 million ozs (75 tonnes), France received 1.284 million ozs, and India received 805,000 ozs. Subtracting all of these from 25 million ozs leaves 14.78 million ozs which was distributed to the other ~120 countries. Since the IMF held 70% of its holdings at the FRBNY in 1976, 19% at the Bank of England and 8% at the Banque de France, apportioning these three weights to the remaining 14.78 million ozs would result in 10.76 million ozs (332 tonnes) being sold from the FRBNY, 2.867 million ozs (89 tonnes) from the Bank of England and 1.24 million ozs (38.5 tonnes) from the Banque de France.

Adding this 89 tonnes to the 75 tonnes received by the UK would be 164 tonnes distributed from the Bank of England IMF gold holdings. Add to this the 116 tonnes of London stored IMF gold sold in the auctions equals 280 tonnes. Subtracting this 280 tonnes from the IMF’s London holdings of 898 tonnes in January 1976 leaves 618 tonnes.

In 2009 the IMF said that it had sold 200 tonnes of gold to India, 2 tonnes to Mauritius, 10 tonnes to Sri Lanka,and then 10 tonnes to Bangladesh in 2010. The Bangladesh figures reflect its 10 tonne purchase. However, at the moment, there has been no exact confirmation that the 200 tonnes that India bought is in London. It probably is in London, but leaving this amount under the IMF holdings instead of in India’s holdings makes no difference. Subtracting the Bangladesh sale of 10 tonnes, and rounding down slightly, there are 600 tonnes of IMF gold (excluding the 2009 India 200 tonnes sale) stored at the Bank of England.

The IMF sales of gold to Sri Lanka and Mauritius in 2009 of a combined total of 12 tonnes probably came out of the IMF’s London holdings also. The IMF’s sale of 181.3 tonnes of gold in 2010 via ‘on-market transactions’ may also have come out of the IMF’s London stored gold. These ‘on-market transactions" look to have used the BIS as pricing agent, and the IMF have gone to great lengths to hide the full details of these sales from public view. More about that in a future article.

India

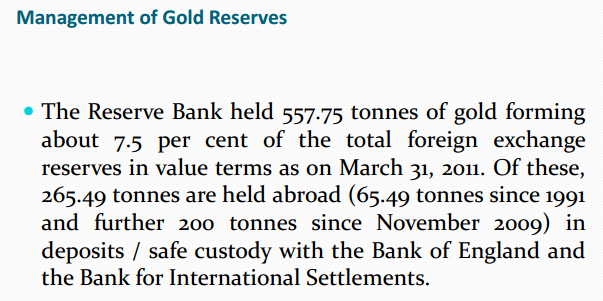

The Reserve Bank of India holds 557.75 tonnes of gold. Of this total, a combined 265.49 tonnes are stored (outside India) at the Bank of England and with the Bank for International Settlements. In 2009 India purchased 200 tonnes of gold from the IMF via an ‘off-market transaction‘. A slide from this presentation sums up this information.

The questions then are, is the 200 tonne purchase from the IMF stored at the Bank of England, and how much of the earlier 65.49 tonnes is stored at the Bank of England.

Bulgaria

Bank for International Settlements

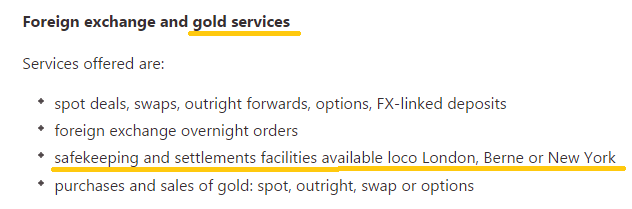

The Bank for International Settlements (BIS), headquartered in Basle, Switzerland does not have run any gold vaults of its own. However, the BIS is a big player in the global central bank gold market, and it offers its central bank clientele gold safekeeping (and settlement) services using central bank vaults in London, New York and Berne. These services are possible because the BIS maintains gold accounts at the Bank of England, the Federal Reserve Bank of New York, and the Swiss National Bank in Berne. BIS gold accounts can act like omnibus accounts in that many central banks can hold gold in sub-accounts under a BIS gold account at each of these institutions in London, New York and Berne.

Gold can then be transferred around locations using gold swaps where one of the counterparties to the gold swap is the BIS.

The BIS is involved with gold in 3 main categories.

a) the BIS holds gold in custody for customers, off of the BIS balance sheet

b) the BIS has its own gold holdings which are classified as its gold investment portfolio, and which are on its balance sheet

c) the BIS accepts gold deposits from central banks. These gold deposits appear as a liability on the BIS balance sheet. Then the BIS turns around and places these gold liabilities in the market under its own name. These placing are also in the form of gold deposits and gold loans with other institutions including commercial banks. These ‘assets’ are then classified on the BIS balance sheet as BIS’ “gold banking" assets.

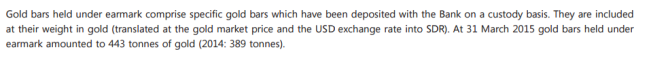

a) In its latest annual report, as of the end of March 2015, the BIS stated that it holds 443 tonnes of gold under earmark for its central bank customers on a custody basis. This gold is not on the BIS balance sheet. i.e. it is ‘off-balance sheet’ gold held by the BIS.

Venezuela

Venezuela holds 361 tonnes of gold. All the Venezuelan gold is held in Caracas in Venezuela at the Banco Central de Venezuela except 50 tonnes are still stored at the Bank of England for transactions such as the gold swap with Citibank. See my article “Venezuela’s Gold Reserves – Part 2: From Repatriation to Reactivation“.

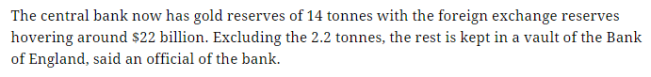

Bangladesh

Bangladesh Bank (Central Bank of Bangladesh) holds 14 tonnes of gold, and 84.2%, or 11.8 tonnes are stored at the Bank of England.

In September 2010, the IMF sold 10 tonnes of gold to Bangladesh Bank, bringing total gold holdings up from 3.5 tonnes to 13.5 tonnes. The fact that this gold is stored at the Bank of England shows that the IMF sold this gold from its holdings that were stored at the Bank of England. (Note, Bangladesh has recently added some small amounts of domestic confiscated gold to its reserves).

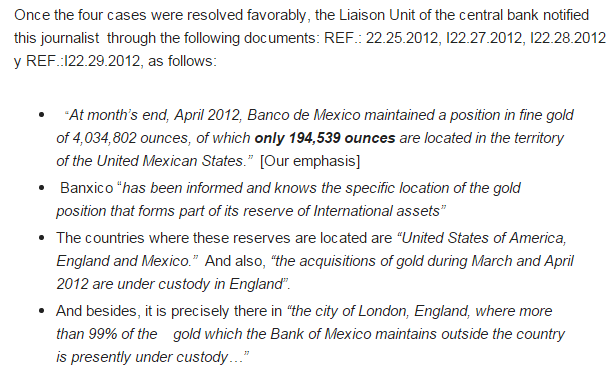

Mexico

Mexico’s central bank, Banco de Mexico (Banxico) currently hold 122.1 tonnes of gold. At the end of 2012, Mexican official gold reserves totalled 4,034,802 ounces (125 tonnes), of which only 194,539 ounces (6 tonnes) was in Mexico, and 119 tonnes abroad.

According to a response from Banxico to Mexican economist Guillermo Barba, 99% of Mexico’s gold stored abroad is at Bank of England. So that is 117.8 tonnes of Mexico’s gold stored at the Bank of England.

With Banxico now holding 122 tonnes according to the World Gold Council, and not 125 tonnes, the assumption is that the 3 tonne reduction came from domestic holdings.

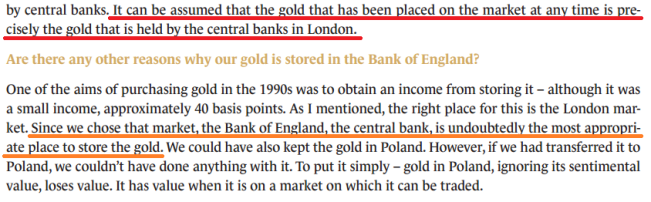

Poland

Poland holds 102.9 tonnes of gold in its reserves. Poland’s central bank (Narodowi Bank Polski (NBP)) published a guide to Poland’s gold in 2014 in which it confirmed that nearly all of its gold is at the Bank of England. See pages 86-90 of the guide.

“How much gold did Poland possess before 1998? Approximately 746,463 ounces, of which almost 721 thousand was invested in deposits in commercial banks. In turn, the gold kept in the country was mainly coins, gold bars and various types of gold “scrap” bought by NBP." (page 86)

Before 1998, only 25,463 ozs of NBP gold was kept in Poland, and 721,000 ozs (22.43 tonnes) was deposited with bullion banks. Poland then bought 80 tonnes of gold in 1998, bringing its gold reserves up to nearly 103 tonnes. The purchase was done as follows:

“…we used the services of a bank which constantly carries out similar transactions. Next, we made a location swap and the whole of NBP’s foreign gold reserves were deposited onto our account in the Bank of England." (page 88)

It is likely that the NBP is referring to the BIS as the bank which purchased the gold on behalf of Poland, and then transferred it from one of the BIS gold accounts at the Bank of England to the NBP gold account at the Bank of England.

So that is 102.9 tonnes stored at the Bank of England.

Note also that, the Polish central bank explains that “It can be assumed that the gold that has been placed on the market at any time is precisely the gold that is held by the central banks in London“. In other words, central banks that have places gold on deposit (lent it) have done so with gold that they have stored in the Bank of England. See the following screenshot:

Note 6.1 on page 136 of the 2013 NBP annual report states:

“Gold and gold receivables The item comprises gold stored at NBP and deposited in a foreign bank account. As at 31 December 2013, NBP held 3,308.9 thousand ounces of gold (102.9 tonnes).”

The annual report is a large file and slow to downlaod so its probably not worth downlaoding it http://www.nbp.pl/en/publikacje/r_roczny/rocznik2013_en.pdf

This statement about the “gold stored at NBP and deposited in a foreign bank account" has been in a few of the recent NBP annual reports. In April 2013, before the NBP had published the guide to its gold, I asked the NBP by email, based on the statement, to clarify if the gold held abroad is held in custody, for example at the Bank of England or FRBNY or held in time deposits with commercial banks?”

The NBP responded: “Narodowy Bank Polski does not make gold time deposits with commercial banks”.

This may be true if the NBP is using sight deposits, but the 2013 answer, like so many other central banks currently, avoided providing any real information to the question.

Given that nearly all NBP’s 102.9 tonnes of gold was in the Bank of England when the 80 tonnes purchase was made in 1998, the assumption here is that still is the case, and that for simplicity, 100 tonnes of Poland’s gold is at the Bank of England.

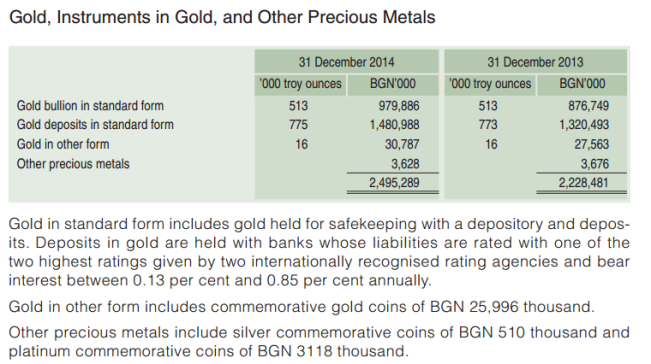

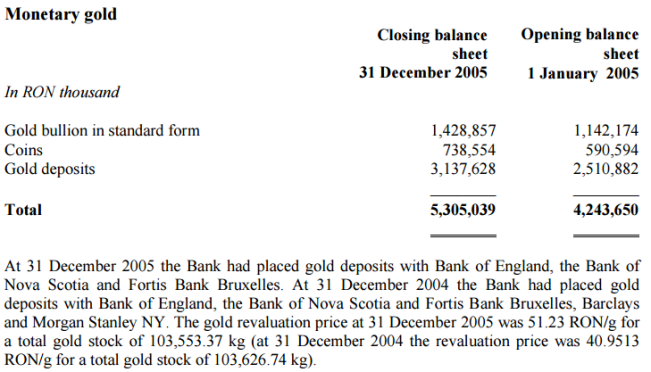

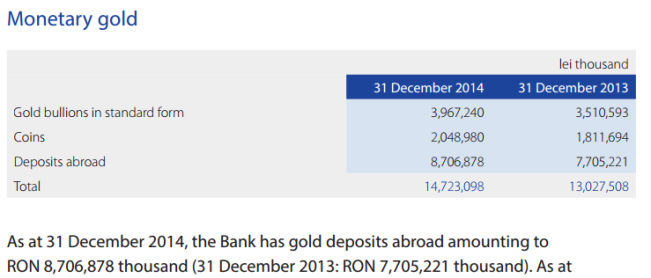

Romania

Romania has 103.7 tonnes of gold in its official reserves.

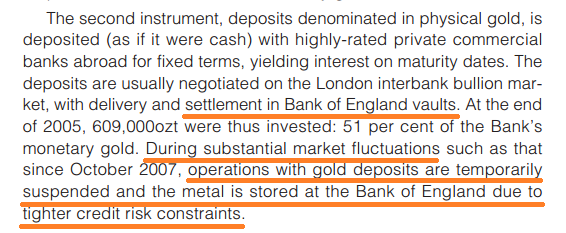

In percentage terms, as at 31 December 2014, 27% of Romania’s gold was in ‘standard form’ which presumably means Good Delivery Bars (400 oz bars), 14% in gold coins, and 59% in ‘Deposits’ abroad. (59% of 103.7 tonnes is 61.2 tonnes)

Looking at earlier financial accounts, and going back to 2005/2004, the Romanian central bank held gold deposits with bullion banks, and gold deposits at the Bank of England, and the percentage of he gold in each of the 3 categories was very similar to 2014, specifically, in 2005 it was 32% in gold bullion in standard form, 13% in gold coins,and 55% in gold deposits.

Note the gold deposits with Bank of Nova Scotia and Fortis Bank Bruxelles in 2005 and additionally with the same two banks and with Barclays and Morgan Stanley NY in 2004.

Since the percentage breakdown between Romania’s bullion bank deposits (59%), standard bars (27%) and coins (14%) hasn’t varied much since 2005, and was at a similar mix over various years that I checked such as 2011 and 2014, the conclusion is that Romania has had more than 50% of its gold on constant deposit since at least 2004 (i.e. the original allocated gold is long gone).

The 2005 annual report also states that there were 61 tonnes of Romanian gold stored at the Bank of England. Since Romania had just under 105 tonnes of gold in 2005, this 61 tonnes was referring to the gold deposits, which central banks, as illustrated in numerous other examples, continue to count as their gold even though it has been lent to bullion banks.

Romania therefore had or has 61 tonnes of gold stored at the bank of England.

Note also the reference to central vault, which probably refers to a vault in Bucharest.

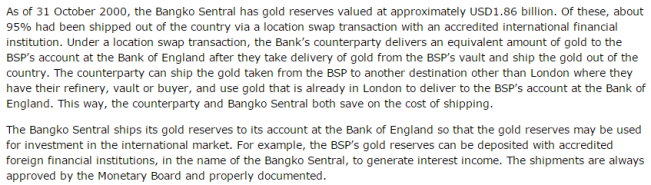

Philippines

The Philippines hold 225 tonnes of gold in its official reserves. In November 2000, when the Bangko Sentral ng Pilipinas (BSP) held 225 tonnes of gold, it explained in a press release titled ‘Shipment of Gold Reserves‘ that it ended up storing 95% of its gold at the Bank of England due to the use of location swaps with a counterparty (probably the BIS) that took delivery of BSP gold, and transferred gold to the BSP account at the Bank of England.

Since 2000, the BSP gold reserves have risen, fallen, and risen again and now total 195 tonnes. Assuming the ‘95% of its gold’ storage arrangement is still in place, then the Philippines has 95% of 195 tonnes, or 185 tonnes stored at the Bank of England.

Greece

Greece claims to hold 112.6 tonnes of gold. In 2013, the Greek finance ministry on behalf of the Greek central bank stated that half of Greece’s gold reserves were ‘under custody’ of the Bank of Greece, and the other half was ‘under custody’ of the Federal Reserve Bank of New York (FRBNY), the Bank of England and (very vaguely) Switzerland. Who actually controls Greece’s gold reserves at this point in time is anybody’s guess.

See my article from February 2015, titled “Spotlight on Greece’s Gold Reserves and Grexit" which explores Greece’s official gold reserves.

Given that the Federal Reserve Bank of New York was listed by the Greek MinFin as a foreign gold storage location ahead of the Bank of England, the assumption here is that of the 50% of Greece’s gold held abroad, the FRBNY holds more of this portion than the Bank of England. And so the assumption is that the Bank of England holds 40% of the foreign half, i.e. 20% of the total of Greece’s gold, with the FRBNY holding 50% of the foreign half. Taking 112 tonnes of gold as Greece’s total gold holding, 40% of this is 22.4 tonnes stored at the Bank of England. (Note, Greek gold reserves keep increasing incrementally each month by small amounts. As I am not sure what these increases relates to, a recent rounded figure of 112 tonnes has been chosen).

Italy

The Banca d’Italia holds 2.451.8 tonnes of gold. Although in 2014, the Banca d’Italia released a document in which it confirmed that some of this gold is held at the Bank of England, there is no evidence to suggest that Italy’s gold in London amounts to more than a few tonnes left over from 1960s transactions.

Bank of England gold set-aside ledgers show that in 1969 there were less than 1000 ‘Good Delivery’ gold bars in the Banca d’Italia gold account at the Bank of England, weighing less than 400,000 ozs in total. This is equal to about 12 tonnes. Most of the Italian gold at the Bank of England was flown back to Rome (and Milan) in the 1960s.

Since there is no public documentation that Banca d’Italia has ever engaged in gold lending (as far as I am aware), then there would be no need for Italy to keep a lot of gold at the Bank of England. Nearly all of Italy’s foreign held gold (over 1,200 tonnes) looks to be in New York (assuming it hasn’t been swapped or used as loan collateral). Italy could have engaged in non-public gold transactions from the Bank of England using gold location swaps from the FRBNY, or from Rome, but there is no evidence of this.

So, this model assumes 12 tonnes of Italian gold is stored at the Bank of England.

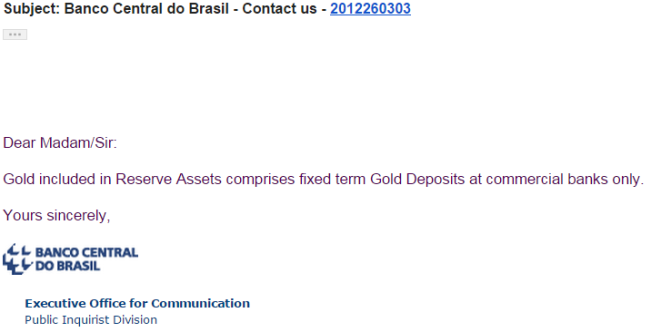

Brazil

Brazil hold 67.2 tonnes of gold reserves. In 2012, Banco Central do Brasil told me by email that all of its gold reserves were in the form of ‘fixed term gold deposits at commercial banks only’. Since the gold would be required to be stored at the Bank of England for these gold deposit transactions to take place, Brazil therefore holds 67.2 tonnes of gold at the Bank of England. See email below:

Ecuador

Bolivia

Peru

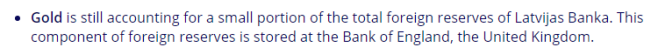

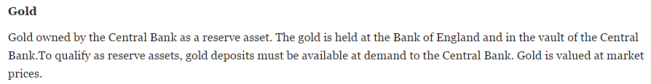

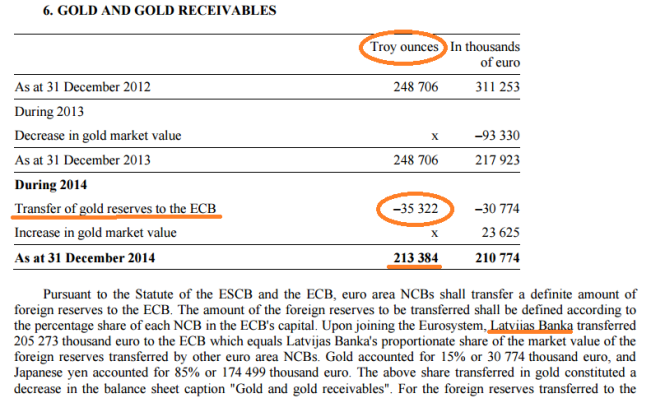

Latvia

Latvia hold 6.62 tonnes of gold in its official reserves after joining the Euro on 1 January 2014 and after transferring just over 1 tonne of gold to the European Central Bank (ECB). All of Latvia’s gold is stored at the Bank of England, therefore Latvia stores 6.62 tonnes of gold at the Bank of England.

The latest annual report of the central bank of Latvia explains this transfer to the ECB.

European Central Bank

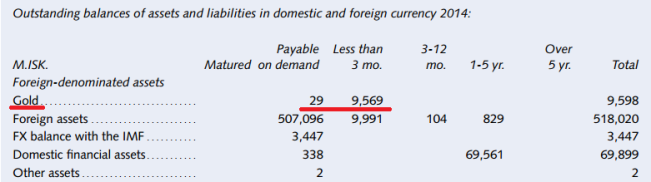

Iceland

Iceland holds 2 tonnes of gold reserves (precisely 63,831.46 ozs). Although the Bank of Iceland says that its gold is stored at the Bank of England and in its own vault also, nearly all the gold is stored at the Bank of England.

In its 2014 annual report, the Bank of Iceland said that “The Bank resumed lending gold for investment purposes in June 2014“, and “The Bank loaned gold to foreign financial institutions during the year”.

The Bank of Iceland lent 99.7% of its gold during 2014 because this is the percentage of the gold reserves which are not payable on demand, but are payable in less than 3 months. See below screenshot.

For the purposes of this exercise, Iceland stores 2 tonnes of gold at the Bank of England.

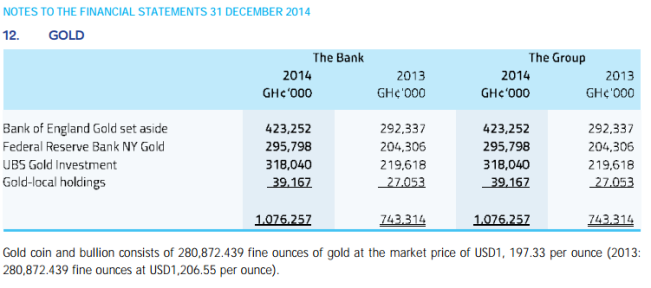

Ghana

Ghana’s central bank, the Bank of Ghana, holds 8.7 tonnes of gold in its official reserves (precisely 280,872.439 ozs). Of this total, 39.3%, or 3.42 tonnes is held at the Bank of England, with 27.5% at the Federal Reserve Bank of New York, and 29.5% with investment bank UBS. See 2014 annual report.

Interestingly, Ghana refers to its gold account at the Bank of England as a ‘gold set aside’ account, which is the correct name for a Bank of England gold custody account of allocated gold. Probably more interestingly is that most central banks do not use this ‘set aside’ term.

Conclusion

A number of central banks refuse to confirm the location of their gold reserves. I will document this in a future posting. Some of the large holders undoubtedly hold quite a lot of gold at the Bank of England, as do a number of smaller holders. Countries that could fit into this category include Spain, France, Colombia, Lithuania, Sri Lanka, Mauritius, Pakistan, Egypt, Slovenia, Macedonia, Malaysia, Thailand and South Africa. In fact any central bank which has engaged in gold lending is a candidate for having some of its gold stored at the Bank of England.

Spanish people take note. Spain refused to say where its 281.6 tonnes of gold is stored, and Banco de España has the dubious record of being Europe’s least transparent bank as regards gold reserves storage locations. Maybe a project for Spanish journalists.

Banque de France keeps 9% of its 2,435 tonnes of gold reserves abroad, and has in the past engaged in gold lending. So this 9%, or 219 tonnes, is probably stored at the Bank of England.

The ECB and BIS no doubt have more gold stored at the Bank of England than the figures currently reflect. This would also increase the ‘known gold’ total. Egypt is another country which has had a gold set aside account at the Bank of England so is in my view an obvious candidate for the list.

Adding to the known total is therefore a work in progress.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Gold at All Time Highs amid Physical Gold Shortages

Gold at All Time Highs amid Physical Gold Shortages

Ronan Manly

Ronan Manly 0 Comments

0 Comments