Should I Invest in Gold & Silver Bars or Coins?

One of the most common questions that precious metals investors of all experience levels ask is “should I invest in bullion bars or coins?” That is a very good question that we will address in detail in this article. The short answer is that both bars and coins are great options for those looking to invest in gold and silver, and the two are not mutually exclusive. Many astute precious metals investors acquire a mix of both kinds of bullion and appreciate each kind for its unique qualities. Ultimately, the decision is a matter of personal preference, but we hope to provide you with valuable information so that you can make the best choice possible.

What is Bullion?

For starters, it’s important to define the term bullion as it’s used quite a bit in the precious metals investing arena. Bullion is a term used for bars, ingots, or coins that are made from precious metals and are intended for investment purposes rather than circulation the way common coins such as pennies, dimes, and quarters are. Bullion bars and coins are minted in standard weights including 1 oz, 10 oz, 100 oz, and 1 kilogram, and standard metal purities such as 91.667% gold or 99.99% gold or silver. The word bullion comes from the old French word “bouillon,” which means “to boil” — a reference to the gold and silver refining process. You may recognize the word “bouillon” from bouillon cubes that are used for making soup and, yes, it’s the same word!

What Are Bullion Bars?

Bullion bars are ingots made from precious metals by refineries and mints for the purpose of holding as investments. Bullion bars contain a known weight of gold, silver, or platinum, in a known and trusted metal purity. Standardization of weights and purities is crucial so that buyers and sellers can easily value bullion bars. Among bars of the same weight and metal purity, there is a great amount of leeway in terms of design and other aesthetic features. There are a wide variety of bullion bars on the market with different weights/sizes, brands, purities, finishes, and security features.

What’s the Difference Between Minted and Cast Bullion Bars?

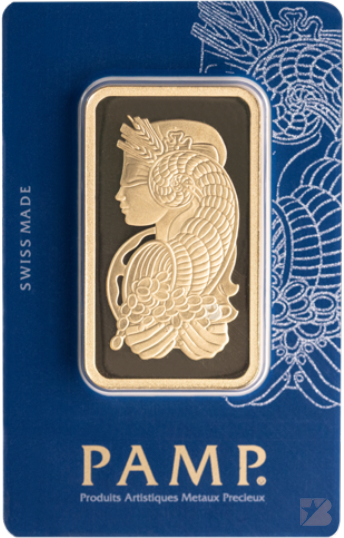

Gold and silver bullion bars come in two main varieties: minted and cast. Minted bars, such as the popular 1 oz PAMP Swiss gold bar, have a sleek, modern, highly-polished finish that results from the refiner cutting the metal to precise dimensions and then stamping the design, the refiner’s logo and stamp, weight, purity, and unique serial number (in some cases).

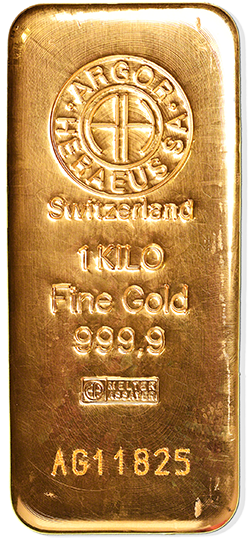

Cast bullion bars, on the other hand, have a rougher finish that results from the pouring of the molten metal into a mold and letting it cool and set. Cast bullion bars, such as the 50 Gram PAMP Swiss cast gold bar, have the refiner’s logo and stamp, weight, purity, and unique serial number (in some cases) impressed onto their surface.

Some investors prefer the sleeker, high-luster finish of minted bullion bars, while others prefer the retro aesthetic of cast bullion bars that look like they belong in a pirate’s treasure chest. There is no right or wrong answer when it comes to the minted vs. cast bullion bar decision; both are solid options and many precious metals investors choose to have a mix of both types of bars.

Bullion Bar Packaging

Many smaller minted gold bars come encased in protective blister packs that also contain the bar’s official assay certificate. Refiners that encase their smaller gold bars in blister packs include PAMP, Valcambi, Argor-Heraeus, and the Royal Canadian Mint. Most large gold bullion bars and most silver bars are not encased in protective blister packs.

Serial Numbers on Bullion Bars

Most gold, silver, and platinum bullion bars have unique serial numbers stamped onto their front surface and/or included on their protective blister pack for authentication purposes. Bullion bars are also typically stamped with the name and logo of the mint or refinery, as well as the bar’s weight and metal fineness. The designs of most bullion bars is consistent from year-to-year unless it is a special edition bar that is made to commemorate certain events or holidays such as Lunar New Year.

Refiners on the LMBA Good Delivery List

When considering gold and silver bullion bars to invest in, it’s always a smart idea to stick with bars made by mints or refiners that are included on the London Bullion Market Association’s (LBMA) prestigious Good Delivery List for gold or silver. Similarly, if you are looking to acquire platinum bars, it’s a much safer bet to choose a refiner that is listed on the London Platinum and Palladium Market’s (LPPM) Good Delivery List for platinum. Only the most respected refiners that produce the highest quality bullion products are included on Good Delivery Lists, so they are helpful for determining the best bullion bar brands to buy.

Precious Metals Purity

Most gold bullion bars are made from gold that is at least 99.99% pure, which will appear as 0.9999 on the face of the bar. Refineries produce gold bars in a very wide variety of weights from tiny 1 gram bars all the way up to hefty 400 ounce bars, but the most popular are 100 gram and 1 kilogram gold bars.

Silver bullion bars are typically made from at least 99.9% pure silver, which will appear as 0.999 on the face of the bar. Silver bars tend to be larger than gold bars because silver is much less expensive than gold. Precious metals refiners produce silver bars in a wide range of weights including 1 oz bars, 100 oz bars, 1 kilogram bars, as well as massive 1,000 oz and 15 kilogram bars.

Though precious metals investors have historically focused on gold and silver, there is a growing subset of investors who are taking an interest in platinum as well. Platinum bullion bars are generally made from at least 99.5% pure platinum, and popular weights include 1 oz, 100 grams, 500 grams, and 1 kilogram.

BullionStar carries a wide assortment of gold, silver, and platinum bars that are produced by respected refiners that are on the LBMA and LPPM Good Delivery lists. Some of the world’s top precious metals refineries include Argor-Heraeus, PAMP, Metalor, and Valcambi (all four are Swiss firms), Germany’s Heraeus, South Africa’s Rand Refinery, and Turkey’s Nadir Refinery. Some of the world’s leading mints, including the Royal Canadian Mint and Australia’s Perth Mint, also operate precious metals refineries and produce gold and silver bullion bars in addition to bullion coins.

Premiums & Spreads on Bullion Bars

Bullion products in the marketplace are almost always priced higher than precious metals spot prices, and that difference is known as a price premium. Premiums are typically expressed as a percentage.

Bullion price premiums are determined by a number of different factors such as:

- The cost of refining, fabrication, and minting that bullion item

- Transportation, distribution, marketing, and wholesaling costs

- Supply and demand for that bullion item

In general, bullion bars have lower premiums than bullion coins due to the lower cost of minting bars. In addition, premiums on large bullion bars are usually lower than premiums on smaller bullion bars because the fixed refining costs amount to a smaller percentage of the overall cost of large bullion bars versus smaller bullion bars. If your primary goal is to get the most gold, silver, or platinum for your money, the best option is to buy large bullion bars — the larger the better. Of course, large bullion bars are bulkier and harder to store and transport compared to smaller bullion products, so it’s a tradeoff.

When you go to purchase gold, silver, and platinum bullion from a dealer, you’ll notice that there are two prices that are quoted: the bid price and the ask price.

The ask price is also known as the buy price and is the current price that customers must pay in order to purchase that particular coin or bar. The bid price is also known as the offer price and is the current price that the dealer is willing to pay a customer for that particular coin or bar. The ask price is always higher than the bid price, and the difference between the two prices is known as the spread. The spread is typically expressed as a percentage.

If you are interested in trading physical precious metals, BullionStar’s 100 Gram No-Spread Gold Bullion Bar and 1 Kilogram No-Spread Silver Bullion Bar are excellent options that will help you to save money.

Bullion Bar Size Considerations

Once you have determined that you want to buy a bullion bar or bars, another important factor to consider is the size of those bullion bars. While large bullion bars help you get the most amount of metal for your money due to their lower premiums and spreads, they are also bulkier and may be less practical if you decide that you would like to sell just a small portion of your precious metals holdings instead of a large amount all at once. For example, it may be more practical to buy thirty-two 1 oz gold bars instead of a 1 kilogram gold bar so that you can sell a few 1 oz bars at a time as needed rather than the entire 1 kilogram bar just because you’d like to sell a small amount of gold. The ideal solution, if funds permit, is to have an assortment of different-sized bullion bars and coins. Like different types of tools in a toolbox, each type of bullion serves a unique purpose, which is why there are so many different types of bullion products in the first place.

Bullion Coins

Now that we have discussed bullion bars, it’s time to discuss bullion coins. Bullion coins are coins that are made from precious metals and are intended for investment purposes rather than circulation the way common coins such as pennies, dimes, and quarters are. Bullion coins are minted in standard weights and metal purities so that they are easy to value and trade in the marketplace. The most popular and recognizable bullion coins are produced by prestigious mints including the United States Mint, the Royal Canadian Mint, the United Kingdom’s Royal Mint, the Austrian Mint, and Australia’s Perth Mint. Mints are typically government-owned facilities that produce both coins for day-to-day circulation as well as valuable precious metal bullion coins.

Types and Characteristics of Bullion Coins

In addition to their value as investments, bullion coins are also known for their beautiful and ornate designs that tie into their names such as the American Eagle series, which depicts a bald eagle on its reverse side, the American Gold Buffalo, which depicts an American bison on its reverse side, and the Canadian Maple Leaf, which depicts a maple leaf on its reverse side. Other popular bullion coins include United Kingdom Britannias, Austrian Philharmonics, Australian Kangaroos, and South African Krugerrands.

As with circulating coins, bullion coins are typically issued by mints each year and are imprinted with the year that the coin was minted. Most bullion coins feature the same design year after year but some coins, such as the Royal Mint’s Queen’s Beasts series and the Perth Mint’s Lunar series, have designs that change each year, which increases their collectability. Many mints are now including security features on their bullion coins such as micro engraving and radial lines to prevent forgery.

Though bullion coins issued by official government mints are intended for investment purposes rather than circulation, they are considered legal tender in the countries in which they are issued. For example, the 1 oz American Gold Eagle coin is legal tender in the United States and has a face value of $50, while the 1 oz American Gold Eagle coin is also considered legal tender and has a face value of $1. In some countries, domestic legal tender bullion coins have tax advantages such as being exempt from sales and capital gains taxes.

Precious Metal Purity

The majority of popular gold bullion coins are made from 99.99% pure gold, though the American Gold Eagle series is made from 22 karat “crown gold,” which is a gold alloy comprised of 91.67% gold, 3% silver, and 5.33% copper. 22-karat gold was chosen over 99.99% pure 24-karat gold due to its greater durability and wear resistance. Silver bullion coins are typically 99.9% or 99.99% pure, while platinum coins are generally at least 99.5% pure. 1 oz coins are the most common weight by far, though many gold bullion coin series are also available in 1/10 oz, ¼ oz, and ½ oz weights. Aside from some special edition coins, most bullion coins aren’t available in sizes larger than 1 oz, so if your goal is to invest in larger bullion pieces, bars are your best option.

Some of the most recognizable and sought after gold bullion coins include the American Gold Eagle, the American Gold Buffalo, the Canadian Gold Maple Leaf, the United Kingdom Gold Britannia, the Austrian Philharmonic, and the Australian Kangaroo. The most popular silver bullion coins are the American Silver Eagle, the Canadian Silver Maple Leaf, the United Kingdom Silver Britannia, and the Australian Silver Kangaroo. Similarly, the most popular platinum bullion coins are the American Platinum Eagle, the Canadian Platinum Maple Leaf, the Austrian Platinum Philharmonic, and the United Kingdom Platinum Britannia.

Premiums & Spreads on Bullion Coins

As discussed in a previous section, bullion products in the marketplace are almost always priced higher than precious metals spot prices, and that difference is known as a price premium. Premiums are typically expressed as a percentage.

Bullion price premiums are determined by a number of different factors such as:

- The cost of refining, fabrication, and minting that bullion item

- Transportation, distribution, marketing, and wholesaling costs

- Supply and demand for that bullion item

In general, bullion coins typically command higher premiums than bullion bars due to the higher cost of minting coins. Popular 1 oz coins from well-known mints typically have reasonable premiums and spreads thanks to their high production volumes and heavy trading in the secondary market. One of the many advantages of buying widely recognizable bullion coins made by the world’s most respected mints is that you can easily sell them to bullion dealers or coin shops around the world. In other words, they are much far more liquid than less popular coins.

In addition to their value as investments, bullion coins make excellent gifts — particularly smaller gold coins and 1 oz silver coins. In many cultures, precious metals are given as gifts for weddings, anniversaries, festivals, holidays, and other special occasions. For those who are interested in preparing for crises (i.e. “preppers”), popular gold and silver coins have been used throughout history during financial crises and wars because they are easy to carry across national borders. For example, British pilots and soldiers have been known to carry small gold coins that can be used if they are behind enemy lines or in a foreign territory.

Conclusion

In this piece, we’ve discussed the key facts about bullion coins and bars, as well as the pros and cons of each one. The reality is that coins and bars from reputable mints and refiners are both excellent ways to invest in gold, silver, and platinum. Many precious metals investors prefer having an assortment of both coins and bars because there are many advantages to having a variety of bullion products, and there’s no rule saying that you need to stick to just one or the other! Just how there are different tools in a toolbox including screwdrivers, hammers, wrenches, and pliers, with each one serving a different purpose, each type of bullion serves a unique purpose. And, if you’re anything like us, you’ll want to acquire bullion in all different shapes, sizes, and precious metals — it never ends!